kane county illinois property tax due dates 2021

Be 65 or older by December 31 2021. Property taxes are paid at the Kane County Treasurers office located at 719 S.

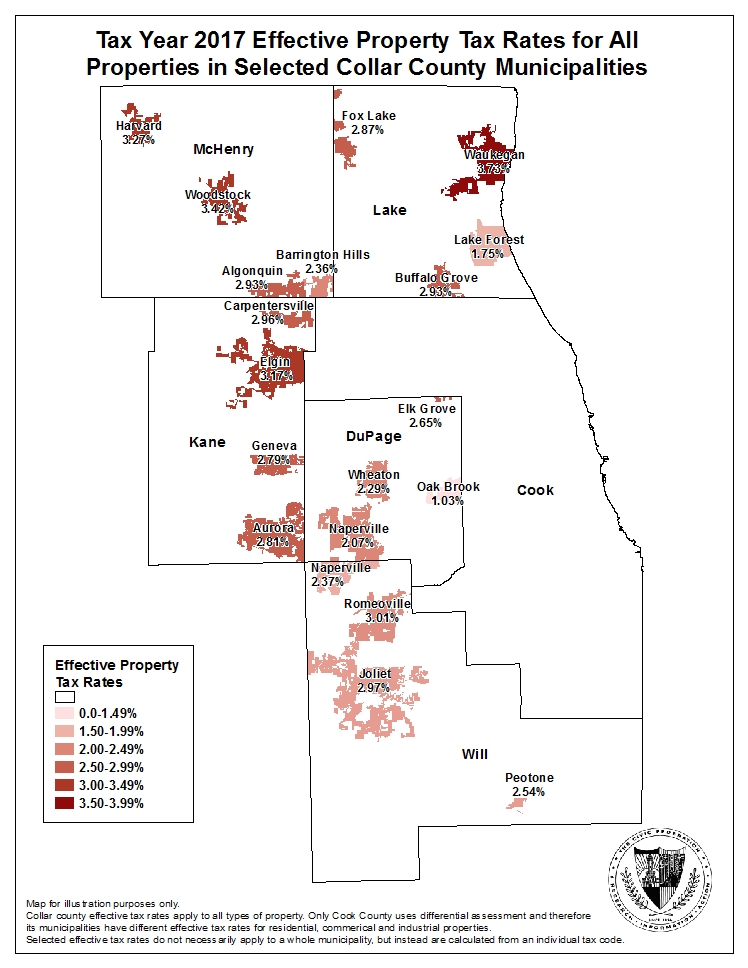

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

We are open during the hours of 800 am to 430pm Monday thru Friday except for holidays.

. Friday October 1 2021. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Once taxes for the selected year have been extended the tax bill will be available.

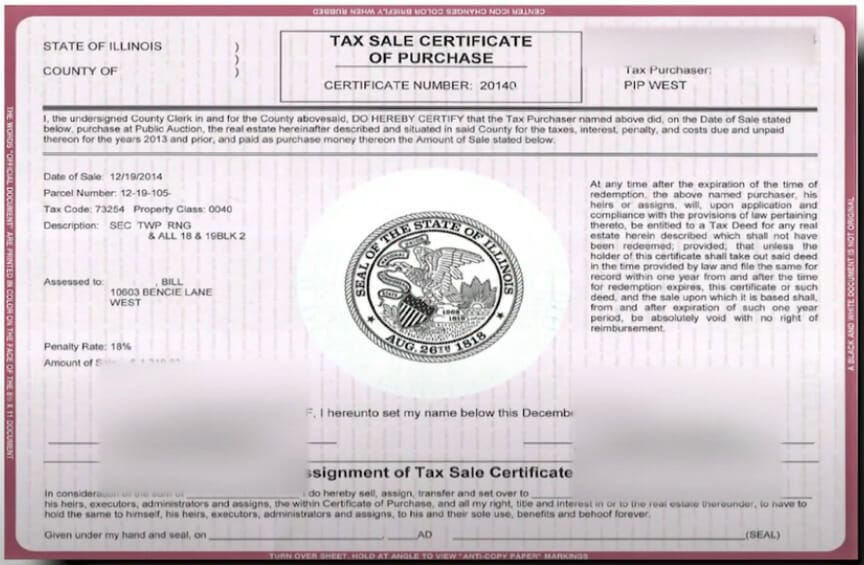

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your. Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Dekalb County Property Tax The certificate is then auctioned off in Kane County IL. County officials will conduct a tax sale on Feb.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Tuesday March 2 2021. According to the Treasurers Office website payments must be.

KANE COUNTY TREASURER Michael J. In most counties property taxes are paid in two installments usually June 1 and September 1. County Assessment Office All of Kane County 6302083818 MF 830 am430 pm.

The levies for each local taxing body are set by each Kane County Unit of Governments governing board. The Kane County Treasurers Office has posted a notice on its website saying unpaid Kane County property taxes are now considered delinquent. Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021.

Kane County Government Center 719 S. Tax Bill Is Not Ready. Tax Year 2020 Second Installment Due Date.

The County Clerk tax staff calculates the tax rate set within statutory limits by the local board for each taxing district t o each propertys. Batavia Ave Bldg A Geneva IL 60134 630-232-3400. Tax bills for Kane County property owners will be mailed out one May 1 with themselves first installment due June 3 and serve second installment due Sept.

3317 - COURTYARDS OF ST. Real-estate Tax bills will be mailed out on July 31 2020 The 1st installment will undermine due on September 2 2020 The 2nd installment will suffocate due on October 16. Kane County Property Tax Inquiry.

To gather at County Assessment Offices just to seek assistance in filling out complicated application forms said Kane County Supervisor of Assessments Mark Armstrong who chairs the Legislative and Policy Committee of the County Assessment. The first installment will be due on or before June 1 2021 and the second installment will be due on or before September 1 2021. CHARLES OFFICE CONDO AMEND PER 2015K018901.

Automatic Renewal of 3 Property Tax Exemptions in 2021 due to COVID-19. The median property tax on a 24500000 house is 423850 in Illinois. Is dedicated to helping companies navigate the complex world of property tax and incentives.

The median property tax on a 24500000 house is 257250 in the United States. The median property tax on a 24500000 house is 512050 in Kane County. CHARLES OFFICE CONDO AMENDMENT.

Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of. 3315 - BUONA ST. We also have a drop box located outside where you can drop of your payments anytime.

Contact your county treasurer for payment due dates. Late Payment Interest Waived through Monday May. 3164 - COURTYARDS OF ST.

The exact property tax levied depends on the county in Illinois the property is located in. 209 of home value. Assistance in filling out these forms is available by telephone only at.

Bldg A Geneva IL 60134 Phone. Tuesday March 1 2022. Batavia Avenue Geneva ILYou may call them at 630-232-3565 or visit their website at.

Just Enter the Address You Want to Research to Receive Printable Tax Records. Kane County Treasurer 719 S. Thursday June 11 2020.

630-208-7549 Office Hours Monday Thru Friday. 20 - 423-429 E CHICAGO STREET CONDO. Tax Year 2020 First Installment Due Date.

For each Public Act we have provided reference to the Illinois Property Tax Code 35. Ad View Past Current Tax Reports for Any Property Within Kane County. The requested tax bill for tax year 2021 has not been prepared yet.

The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. Kane County collects on average 209 of a propertys assessed fair market value as property tax. The 1st installment will be due on or before June 1 2021 and the 2nd installment will be due on or.

2021 Legislative Updates to the Property Tax Code. Kane County has one of the highest median property taxes in the United States and is ranked 32nd. You may sign up with your email address to receive installment due date reminders and payment notifications for.

The contents of this notice are informational only and do not take the place of statutes rules or court decisions. Tax Year 2021 First Installment Due Date. Welcome to the Kane County Treasurer E-Notify Service.

But that still gives delinquent taxpayers an opportunity to make their property tax payments. You may pay your real estate taxes in person at the Kendall County Collectors Office. Yearly median tax in Kane County.

And Have a total household income as defined below no greater than 65000 in 2020. Chicago based and nationally focused Kane Co. We are located at 111 West Fox Street Yorkville on the 1 st floor Room 114.

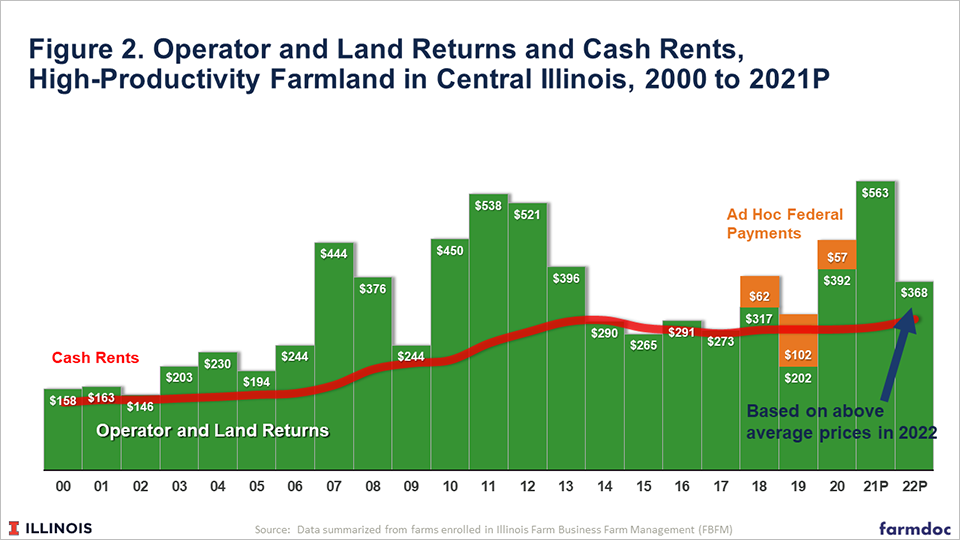

Recent State Soybean And Corn Yields In Illinois Farmdoc Daily

Cash Rents Rise In 2021 With Implications For 2022 Farmdoc Daily

Mclean County Officials Extend Property Tax Due Date May Delay Interest Penalties Because Of Coronavirus Politics Pantagraph Com

Is Illinois A Tax Lien Or Tax Deed State And Why Is It A 1 Choice Tax Lien Certificates And Tax Deed Authority Ted Thomas

How To Pay Your Property Tax Bill In Kane County Il Kane County Connects

Cash Rents Rise In 2021 With Implications For 2022 Farmdoc Daily

Illinois Kayaking Laws Rules And Regulations Paddle Camp

How To Appeal Property Taxes In Geneva Il Beautiful Places Valley View Chicago Suburbs

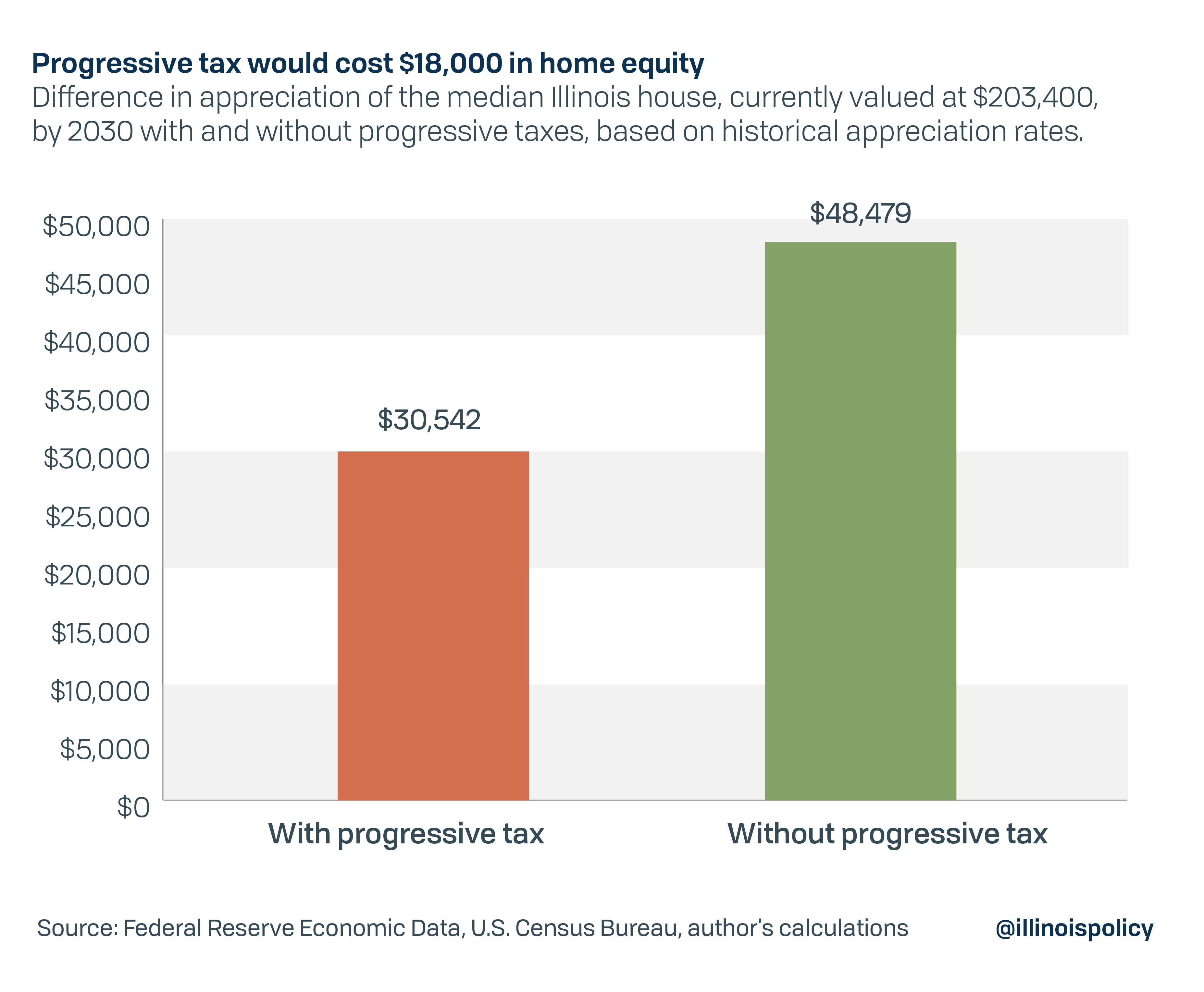

Progressive Tax Could Cost Nearly 1 800 A Year In Home Equity Illinois Policy

Covid 19 Update Global Infections Pass 200 Million Illinois Mandates Masks In Schools 71 New Kane Cases Kane County Connects

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

3243 W Sunnyside Ave Unit 2w Chicago Il 60625 2 Beds 1 Bath Sunnyside Chicago Chicago Events

2022 Best Places To Buy A House In Dupage County Il Niche

Recent State Soybean And Corn Yields In Illinois Farmdoc Daily

2021 Illinois Tax Filing Season Begins Friday Feb 12 Kane County Connects

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

Senator Bill Cunningham Sencunningham Twitter

Property Tax Bills Will Be In The Mail By May 1 First Installment Due June 1 Kane County Connects

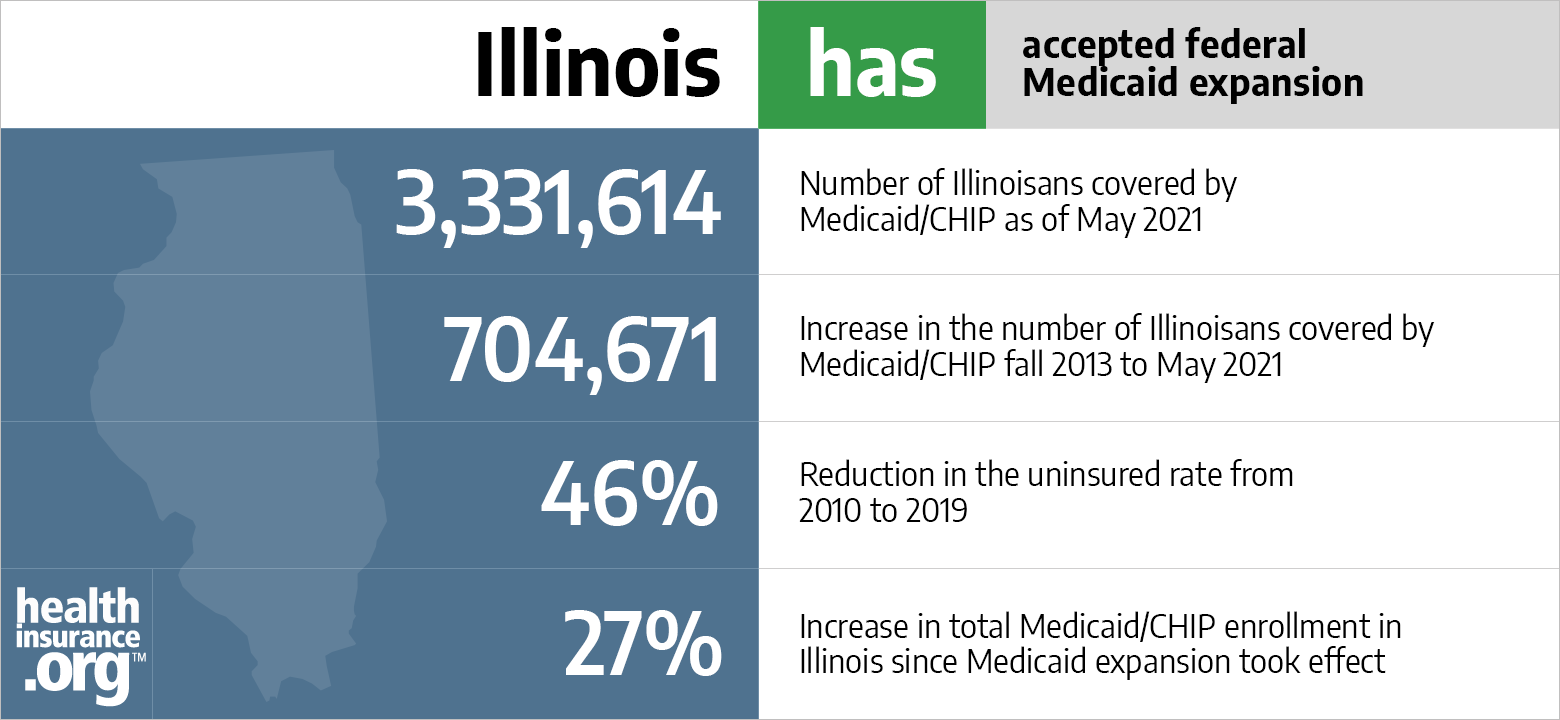

Aca Medicaid Expansion In Illinois Updated 2022 Guide Healthinsurance Org